The prodigal son has returned.

The government on Friday announced Tata Group as the winning bidder for Air India, clearing the way for the cash-strapped Maharaja going back to the founder exactly 68 years after India had nationalised its private airlines in 1953. The Tata’s wholly-owned subsidiary Talace Pvt Ltd put an enterprise value (EV) bid at Rs 18,000 crore with debt to be retained at Rs 15,300 crore and cash component of Rs 2,700 crore.

Article by Saurabh Sinha | TNN

This was higher than the Ajay Singh-led consortium’s enterprise value (EV) bid at Rs 15,100 crore with debt to be retained at Rs 12,835 crore and cash component of Rs 2,265 crore.

The salt-to-satellite conglomerate will now take over Air India (the merged AI-Indian Airlines entity), AI Express and AI’s 50% stake in ground handling firm AI-SATS, before the end of this fiscal. The Tatas’ bid, in the government’s third time lucky attempt to sell AI, was higher than a consortia comprising of SpiceJet promoter Ajay Singh.

Tatas are now going to consolidate their airlines business as they now have two budget airlines — AI Express and AirAsia India — and as many full service ones — AI and Vistara.

Three airlines are likely to be integrated first. Vistara’s 49% stake holder, Singapore Airlines (SIA), will decide on its next step — whether to merge in the AI fold or remain a separate airline — in the coming months.

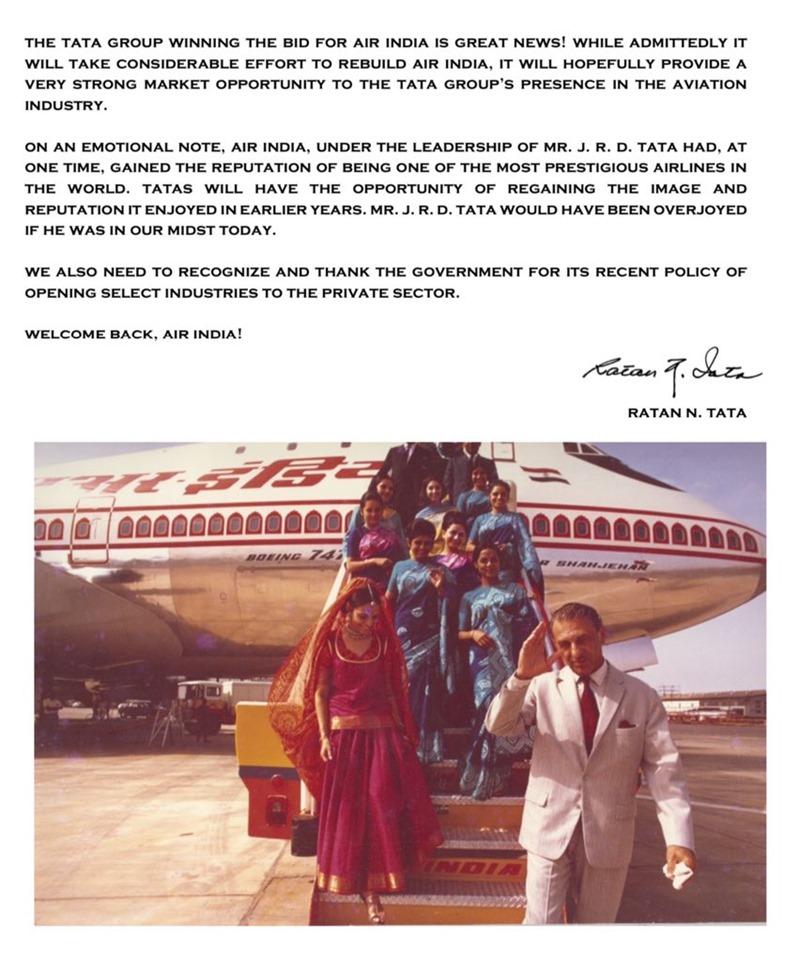

File photo of JRD Tata

This biggest ever consolidation in Indian airline industry means an end to uncertainty over AI survival as the government had made it clear it will have to shut down the Maharaja — that has a accumulated debt-cum-losses of about Rs 1 lakh crore and loses an additional Rs 20-25 crore daily — in case no one bought it.

JRD Tata had prophetically advised PM Nehru in 1952 against nationalising airlines as he was “sincerely convinced the nationalisation scheme (was) not sound and will not result in the creation of an efficient and self-supporting air transport system…”

Read Also

For passengers, the return of the prodigal son means that AI’s nonstops across the globe will continue. There’s also hope that the degraded onboard experience will improve with time.

Air India’s return to @TataCompanies marks a new dawn for the airline! My best wishes to the new management, and co… https://t.co/6v6lO4FW7u

— Jyotiraditya M. Scindia (@JM_Scindia) 1633695537000

Struggling to survive for years, the government-owned AI was not able to spend on cabin upgrade for a long time.

While its planes can safely do the longest nonstops like Delhi-San Francisco/Auckland, a majority of inflight entertainment screens don’t work.

The seats are in urgent need of repairs as part of the overdue cabin upgrade.

Whether Tatas decide to refurbish the current fleet or replace some old ones with brand new fuel-efficient aircraft cheaply available during the pandemic remains to be seen.

Tatas will get AI’s intangible assets like 4,400 domestic and 1,800 international landing and parking slots at Indian airports; and 900 slots at airports abroad.

The remaining amount will be transferred to a SPV, Air India Assets Holding Ltd (AIAHL). The SPV will monetise AI’s assets like property and land bank and use those funds to pay off the debt.